东方汇理资产管理董事长:绿色转型的挑战与金融业应对

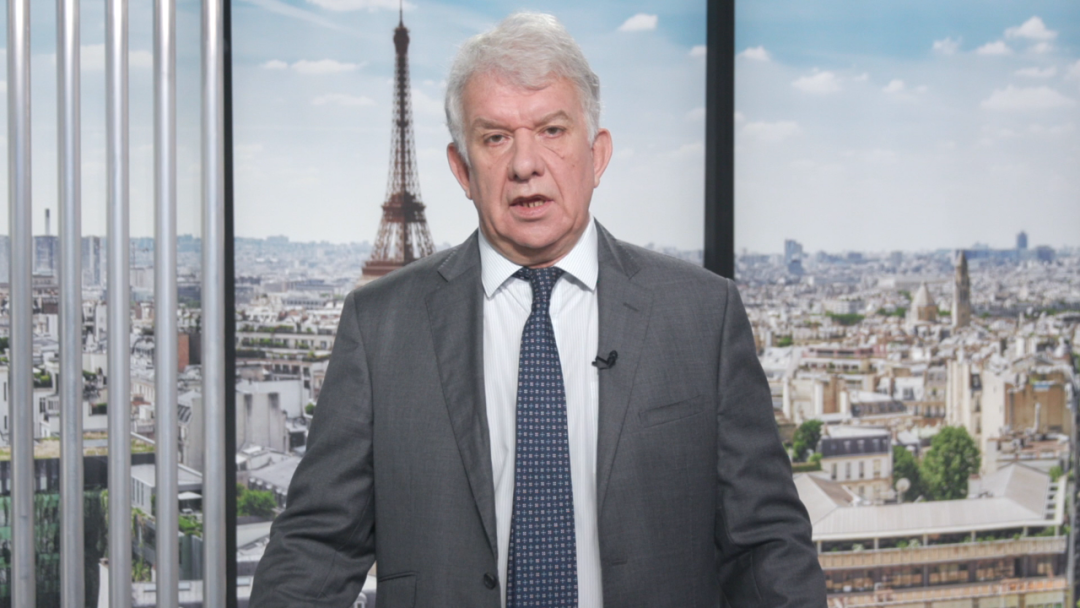

东方汇理资产管理董事长伊夫·贝理叶先生(Yves Perrier)近日出席全球财富管理论坛上海苏河湾峰会时,进行了题为《绿色转型的挑战与金融业在其中发挥的作用》的主题演讲。贝理叶先生通过分享东方汇理资产管理近几年在ESG方向的投资经验,从业务方向、业绩需求与社会责任三个方面深入浅出地阐释了ESG与全球经济绿色转型之间相互促进的发展内涵。基于东方汇理资产管理在ESG方面的前瞻性实践,贝理叶先生总结出全球金融机构在绿色转型过程中将面临来自技术创新、人才储备以及市场主体参与度的三大挑战,同时简要介绍了东方汇理资产管理应对这些挑战的一些初步经验。最后,贝理叶先生从行业层面指出,在全球经济绿色转型过程中,金融机构需要担当起弥合能源转型目标差距与融资缺口的责任,促进政府、企业与金融机构间的良性合作,为2050年达成碳中和目标奠定坚实基础。

以下为演讲全文。

绿色转型的挑战

与金融业在其中发挥的作用

伊夫·贝理叶

自2010年创立以来,东方汇理资产管理一直是可持续和责任投资领域的先锋。三年前,我们启动了一项计划,旨在将环境、社会和治理(ESG)融入到我们所有的业务中。目前该计划已得到充分落实。我很高兴有机会与大家分享东方汇理资产管理在可持续发展和ESG投资方面的经验。

去年,我们将ESG标准纳入了所有的在管主动型开放式基金。我们在环境与社会凝聚力方向的资产管理规模已达到了320亿欧元,我们的评级方法覆盖了超过13,000家公司。如今,作为一家领先的责任投资资产管理公司,我们管理的ESG资产超过8,000亿欧元。到2022年底,我们所有的基金也将设有“能源转型绩效”目标。

金融机构在弥合能源转型过程中的目标差距与融资缺口方面的问题上可发挥关键作用。金融机构向所有经济体的低碳过渡转型提供资金,并将成为向市场发出信号以及影响公司战略的关键。出于这些原因,我们去年加入了承诺到2050年实现碳中和的“净零碳排放资产管理人倡议”。

东方汇理资产管理相信,金融业乃至整个私营部门都有责任将ESG纳入经营范畴,至少有以下三个主要原因:

-

金融业对社会负有重大责任。作为一家责任投资公司,我们必须将资金用于与能源转型和社会凝聚相关的项目,并与相关企业合作,以提高其日常业务中的ESG绩效;

-

将ESG要素纳入投资决策,使之成为长期财务业绩的驱动因素。当今世界,无形资产构成公司整体估值的重要组成部分,责任投资使得把握长期来看具有决定性意义的标准成为可能。换言之,与人们最初看法相反,落实ESG与财务表现二者之间并不矛盾;

-

加快实现ESG目标,是东方汇理资产管理全球增长内涵的头等要务。尽管我们已开启了这段非凡的可持续发展之旅,但要实现净零碳排放,依然任重而道远。

绿色转型的挑战

为实现2021年ESG计划,东方汇理资产管理进行了重大转型。为达成到2025年的ESG目标,我们深知,面对绿色转型所带来的挑战将是一个持续的过程,ESG的内涵也将变化多端。我们不得不面对技术创新及落实、人才储备还有市场主体参与度这三个主要挑战。

技术创新及落实的挑战:一家公司的ESG落实成功背后,是卓越的数据管理和技术创新,包括清晰的ESG数据战略、与众多第三方数据供应商的合作、实现数据采集维度和质量的效用最大化,以及定向生成分析和评级的能力,以反映公司对ESG重要性的价值认同。利用东方汇理资产管理的专业知识,我们创建了ALTO Sustainability,为超过13,000家公司进行评级,拥有大约40,000家公司的ESG数据。

人才储备的挑战:要成功整合ESG,除了配置个别ESG专家和投资专业人员外,整个组织也要坚信ESG的重要性,并对风控、审计、投资顾问、策略分析师等人员进行ESG要素方面的培训。此外,公司必须开发内部培训工具和平台,并在部门内进行内容共享,确保前台业务条线和中台职能部门了解最新发展。在东方汇理资产管理,团队从过去仅几十名经理和ESG专家,扩充至目前超过850名专职处理ESG相关事务的专业人员。

市场主体参与度的挑战:根据企业原有的ESG表现,在投资组合中调高或降低其权重,虽然向市场传递了价格信号,但这并未帮助企业改善其ESG表现。我们与企业间的持续沟通理应贯穿整个财务年度而不应仅限于股东大会期间,这对于帮助企业实现有效的ESG变革至关重要。在东方汇理资产管理,我们通过薪酬决议、气候问题例会、股东大会决议,以及对落后公司使用制裁投票,将ESG与我们所有的决策流程系统性地结合在了一起。

金融行业的角色

实现碳中和目标关乎每一个人:政府、企业及金融机构概莫能外。要想快速收获切实的业绩,唯一的办法就是实现企业、政府和金融机构在利益和战略方面的协同一致。金融机构要发挥以下两个作用:为碳过渡需求提供资金,以及影响和帮助正在进行碳过渡的企业。金融机构对致力于气候行动的承诺至关重要,对这些承诺保持透明及后续承诺的兑现则要求我们言出必行。

根据国际能源机构的最新报告,要在2050年实现全球碳中和,就需要发展中国家的清洁能源投资每年增长7倍,至2030年达到1万亿美元。政府财政可以发挥重要作用,但光靠财政是不够的,碳中和的融资需求与可用融资之间还存在巨大差距。作为应对,我们必须撬动市场资本并适当地进行金融创新,才能确保资产端与资金端的匹配。

尽管金融机构不能取代政策制定者,但在帮助弥合能源转型目标差距与融资缺口这两个方面,金融机构的作用无可替代,甚至还可以产生非常重大的影响:

-

金融机构在产业界的众多公司持有股份,可以通过管理和投票表决对公司施加影响,帮助企业实施应对气候变化的战略,并为它们提供为推动真正的行业改革所需的资源,从而缩小能源转型目标差距;

-

金融机构所支持的融资项目将把经济重新导向适应气候变化的低碳模式,资本配置决策最终会影响资金成本,从而缩小融资缺口。

欧洲的分类体系以及可持续投资方法与美国同行略有不同。在欧洲,我们不仅关注气候变化对企业的实质性风险,还关注企业业务对气候的影响,这种“双重实质性”与美国有着重要区别。亚洲也在快速推进相应标准的制定,我相信欧亚之间将有很多合作机会。

从东方汇理资产管理的经验来看,我认为公私合作伙伴关系是协调利益、关照投资者和应对上述转型挑战的最佳方式。通过制定创新性的投资办法,如“亚洲基础设施投资银行气候变化投资框架”,使发达国家的投资者和资本能够多快好省地流向新兴市场并参与到那些有影响力的投资机会中去。该框架背后的理念在于为机构投资者提供实用工具,帮助其甄别在不久的将来亚洲新兴经济体中最有能力应对气候变化影响的公司。

结论

为了达成《巴黎协定》目标,金融机构需要立马行动,确保重大变革如期实现。若要避免在气候变化方面承受巨大财务和社会代价,未来十年至关重要。

我们必须应对绿色转型带来的诸多挑战,包括技术创新的迅速迭代、治理手段的落实、人才的储备、市场主体的参与度以及产业界、金融机构和政府之间的有机合作。对金融业而言,担当起弥合能源转型目标差距和融资缺口的重任尤为重要。

如东方汇理资产管理所为,加入“净零碳排放资产管理人倡议”,促使金融机构的气候政策透明化,并勇于对参股企业的管理层投反对票,到2030年达成部分目标,以确保在2050年完全实现对碳中和的承诺。

Challenges of Green Transformation

and the Role of Financial Industry

Yves Perrier

Amundi has been one of the pioneers in sustainable and responsible investing since its creation in 2010. Three years ago, we launched a plan to integrate ESG in all our business. This has been successfully completed. I am glad to be given the opportunity to share with you Amundi's experience with sustainability and ESG investing.

Last year, 100% of our actively-managed open-ended funds has integrated ESG criteria. Our initiatives for environmental and social cohesion have reached €32 billion in asset under management, and our rating methodology covers more than 13,000 companies. Today, we are the leading responsible asset manager managing over €800 billion in ESG assets. By the end of 2022, all of our funds will also have an "energy transition performance" objective.

It is clear that the financial sector has a key role to play in helping to close the ambition gap and the financing gap of the energy transition. Financial institutions will have to finance the carbon transition of all our economies and will be key in sending messages to the markets and influencing corporate strategies. For these reasons, last year, we joined the Net Zero Asset Managers Initiative committing to reach carbon neutrality by 2050.

At Amundi, we are convinced that the financial industry, and the private sector in general, have the responsibility to integrate ESG criteria for at least three main reasons:

1. Financial sector has a strong responsibility towards society. As a responsible asset manager, we have to direct capital towards projects related to the energy transition and social cohesion and engage with companies to improve their ESG performance in their day-to-day business;

2. The integration of ESG in investment decisions is a driver of long-term financial performance. In a world where intangible assets represent an important part of the overall valuation of companies, responsible investing makes it possible to capture the criteria that will be decisive over the long term. In other words, there is no contradiction between ESG performance and economic and financial performance, on the contrary;

3. The acceleration of our ESG ambition is the first level of growth for Amundi globally. Even though we recognize that we have been on a remarkable sustainability journey, we acknowledge that we still have a long way to go in the race to net zero.

Challenges of the green transformation

In order to achieve our 2021 ESG Ambitions Plan, we have significantly transformed the company. To deliver the ESG Ambitions Plan we set forward for 2025, we know at Amundi that facing the challenges of the green transformation is an on-going process and ESG is a fast moving environment. The main challenges we have had to face are: 1) a technological innovation and operational challenge, 2) a human challenge, and 3) an engagement challenge.

A technological innovation and operational challenge: Behind a company's ESG success lies excellent data management and technological innovation, including a clear ESG data strategy, working with many third party data vendors, maximizing scope and quality of the inputs, and the ability to produce proprietary analytics and ratings that reflect the company's values and views of ESG materiality. Capitalizing on this expertise at Amundi, we created ALTO Sustainability, which is rating more than 13,000 companies and having ESG data on around 40,000 companies.

A human challenge: For a successful ESG integration, the entire organization, beyond ESG specialists and investment professionals, needs to be convinced about ESG materiality and trained on ESG factors, including risk managers, auditors, counsels, strategists, and so on. Additionally, a company has to develop internal training tools and platforms, and share content within its departments, to keep up to date its investment professionals and support functions. At Amundi, we have moved from a few dozens of committed managers and ESG specialists to over 850 investment professionals that have to deal with ESG in their daily routine.

Last, but not least, an engagement challenge: Overweighting or underweighting corporate in our portfolios according to their ESG performance sends an important signal but does nothing to help corporate improve their ESG performance. Constant dialogue with companies, not only during general assemblies but also throughout the year, is fundamental to obtain effective change in ESG issues. At Amundi, we systematically include ESG criteria in all our votes, through compensation-related resolutions, Say-on-Climate and shareholder resolutions, and the use of sanctions vote on the companies lagging behind.

Role of the financial industry

Achieving the objective of carbon neutrality is everyone's business: public authorities, companies, and the financial sector too. The only way to get concrete and rapid results is to align interests and strategies between corporate, public authorities and financials. Financial institutions have two roles: to finance carbon transition needs, and to influence and help corporate in this transition. Financial sector commitment towards climate action matter, and transparency on the commitments and their realization is critical to ensure that we walk the talk.

According to a new report from the International Energy Agency, achieving global carbon neutrality by 2050 requires a seven-fold increase in annual clean-energy investment in the developing world to reach one trillion dollars by 2030. Public capital has a significant role to play, but it will not be sufficient on its own: the challenge lies in the gap between the financing needs on the one hand, and the financing available on the other. We must therefore leverage on private capital and appropriate innovative financial solutions to do so, making sure that investments are able to flow to the projects that need them.

My conviction is that even though the financial sector cannot be a substitute for policy makers, we are in a unique position to have a very significant impact in helping to close ambition and financing gaps of the energy transition:

1. We hold stakes in companies and can influence them through our stewardship and voting policies, helping corporate along their climate change strategies and giving them the resources they need to implement what is a real industrial revolution, closing the climate ambition gap;

2. We finance projects to re-orient the economy towards a low carbon model resilient to climate change, and our capital allocation decisions ultimately impact the cost of capital, closing the climate financing gap.

Having said that, European taxonomies and our approach to sustainable investing differ from our US peers. In Europe, we not only look at risk materiality of climate change on corporate, but also on impacts their businesses have on climate. This "double materiality", as we say, in an important difference with the US. Asia is moving fast, setting its own standards. I am sure we have a lot in common to work on.

From Amundi's experience, I believe that public-private partnerships are the most effective way to align interests, reassure investors, and provide leverage for the transition challenges mentioned before. We actively work to enable investors and capital of developed countries to flow more and better towards impactful investment opportunities in emerging markets, through developing innovative investment approaches, such as the AIIB Climate Change Investment Framework. Amundi's idea behind this framework is to offer institutional investors with practical tools to select and differentiate companies in emerging Asian economies that are most equipped to face the consequences of climate change in the near future.

Conclusion

In conclusion, I believe that to align with the Paris Agreement, urgent action from the financial industry is required so that the significant changes we need materialize on time. The coming ten years are key if we want to avoid huge financial and social costs related to climate change.

We have to address numerous challenges that the green transition is bringing: acceleration of technological innovation, operational challenge, human challenge, engagement challenge, better cooperation between corporate, financials and public authorities. The responsibility of the financial industry to close the ambition and the financing gap of the energy transition is key.

As what Amundi did, join the Net Zero Asset Managers Initiative, commit to carbon neutrality by 2050, with early steps as of 2030, make your climate policy transparent and do not be shy to vote against management.

全球财富管理论坛

全球财富管理论坛是在金融开放背景下,为顺应全球资产管理行业发展与中国资产管理行业转型需求,由清华大学经济管理学院、孙冶方经济科学基金会、中国财富管理50人论坛联合发起成立的一个国际性交流平台组织,论坛旨在构建一个汇聚全球资产拥有者和管理者、监管部门和市场代表的长期对话沟通平台,为国内外资产管理机构搭建交流与合作的桥梁。